Home » Posts tagged 'services'

Tag Archives: services

Emergency Plumbing: What to Do Before the Plumber Arrives

Plumbing emergencies can be stressful, unexpected, and potentially damaging to your home. Issues like burst pipes, gas leaks, or sewer backups require immediate attention to prevent extensive damage and costly repairs. While waiting for a professional Plumber Longview WA to arrive, there are essential steps you can take to mitigate the situation and protect your property. This guide will help you handle urgent plumbing issues effectively until help arrives.

Plumbing emergencies can be stressful, unexpected, and potentially damaging to your home. Issues like burst pipes, gas leaks, or sewer backups require immediate attention to prevent extensive damage and costly repairs. While waiting for a professional Plumber Longview WA to arrive, there are essential steps you can take to mitigate the situation and protect your property. This guide will help you handle urgent plumbing issues effectively until help arrives.

1. Burst Pipes

A burst pipe can quickly cause severe water damage to your home, so taking immediate action is crucial.

What to Do:

- Shut Off the Water Supply: Locate and turn off the main water shutoff valve to stop the water flow. The main shutoff valve is usually found near the water meter, basement, or crawl space.

- Drain the Pipes: Open faucets to release any remaining water and relieve pressure.

- Contain the Leak: Use buckets, towels, or a temporary patch, such as rubber and a hose clamp, to minimize water spread.

- Turn Off Electricity (If Needed): If water is near electrical outlets or appliances, shut off the power to prevent electrocution.

- Call a Plumber: Provide details about the burst pipe and its location to expedite the repair process.

2. Gas Leaks

Gas leaks pose a serious threat to health and safety, requiring immediate action to prevent fire or explosion.

What to Do:

- Evacuate Immediately: Leave the premises without using electrical switches, matches, or anything that could create a spark.

- Shut Off the Gas Supply: If safe, turn off the gas valve, typically located near the gas meter.

- Ventilate the Area: Open doors and windows to allow gas to dissipate.

- Do Not Use Electronics or Open Flames: Avoid using mobile phones, lighters, or any ignition sources near the leak.

- Call the Gas Company or Emergency Services: Report the leak and wait for professional assistance outside your home.

3. Sewer Backups

A sewer backup can cause wastewater to overflow into your home, creating a hazardous situation.

What to Do:

- Stop Using Water: Avoid flushing toilets, running sinks, or using appliances like dishwashers and washing machines.

- Block Off the Affected Area: Keep children and pets away from the backup.

- Turn Off Power (If Necessary): If sewage is near electrical sources, switch off the electricity.

- Wear Protective Gear: Use gloves, boots, and masks to prevent direct contact with contaminated water.

- Call a Plumber: Describe the issue so they can bring the necessary equipment for cleanup and repairs.

4. Overflowing Toilets

An overflowing toilet can cause water damage and unsanitary conditions.

What to Do:

- Turn Off the Water Supply: Locate the shutoff valve behind the toilet and turn it clockwise.

- Use a Plunger: Try plunging to clear any blockage.

- Add Dish Soap and Hot Water: Pour dish soap into the bowl, followed by hot water, to break up the clog.

- Use a Drain Snake: If plunging doesn’t work, a drain snake can help remove the obstruction.

- Call a Plumber: If the problem persists, professional intervention is needed.

5. Leaking Water Heater

A leaking water heater can indicate a serious problem and may lead to flooding or property damage.

What to Do:

- Turn Off the Power Supply: If the heater is electric, switch off the breaker. For gas heaters, turn off the gas valve.

- Shut Off the Water Supply: Locate the cold-water valve above the heater and turn it off.

- Drain the Tank (If Necessary): Attach a hose to the drain valve at the bottom of the tank and direct it to a safe drainage area.

- Check for Leaks: Inspect the tank for cracks or loose connections.

- Call a Plumber: Provide details on the leak for prompt assistance.

6. Frozen Pipes

Frozen pipes can burst if not addressed quickly.

What to Do:

- Shut Off the Water Supply: Prevent further pressure buildup by turning off the main valve.

- Thaw the Pipes Gradually: Use a hairdryer, heat lamp, or warm towels to slowly thaw the pipes.

- Avoid Open Flames: Do not use torches or direct heat sources to prevent pipe damage.

- Check for Leaks: Once thawed, inspect for any cracks or leaks.

- Call a Plumber: If the pipe has burst or remains frozen, professional repair is necessary.

7. Clogged Drains

A clogged drain can lead to slow drainage or complete blockages.

What to Do:

- Use a Plunger: Try to dislodge the clog with a few forceful plunges.

- Try a Drain Snake: A plumbing snake can help break up deeper clogs.

- Use Baking Soda and Vinegar: Pour a cup of baking soda followed by vinegar to dissolve minor blockages.

- Avoid Chemical Drain Cleaners: These can damage pipes and worsen the issue.

- Call a Plumber: If the clog persists, professional tools may be needed.

8. Leaking Faucets or Pipes

Leaks can waste water and increase utility bills.

What to Do:

- Turn Off the Water Supply: Close the shutoff valve near the fixture or the main valve.

- Tighten Loose Connections: Use a wrench to secure any loose fittings.

- Use Plumber’s Tape or Epoxy: Apply temporary fixes to minimize leaks.

- Catch Dripping Water: Place a bucket under the leak to prevent damage.

- Call a Plumber: A permanent repair will be needed to stop the leak completely.

Conclusion

Handling plumbing emergencies effectively before a plumber arrives can prevent significant damage and ensure safety. Knowing where your main shutoff valves are and keeping basic plumbing tools on hand can make a big difference. However, always prioritize safety and call a professional plumber to ensure proper repairs. With these proactive steps, you can minimize the impact of plumbing emergencies on your home.

The Benefits of 3D Design Consulting

In a world where customization and personalization are becoming defining features, 3D Design Consulting allows clients to create unique products and spaces that reflect their tastes and preferences. They also help reduce costs by facilitating communication between designers and contractors.

For example, furniture manufacturers can use a 3D model to visualize layouts before they start production. They can also show customers how a piece will look in their homes or offices.

3D modeling

3D modeling is the process of creating a digital representation of an object in three dimensions. It is used in a variety of industries, including architecture and engineering. It can be created manually or by using specialized software. The process consists of mapping virtual points in space to create shapes, lines, curves, and other geometric entities. The resulting mesh is called a model, and it can be manipulated to produce different textures or even animate the object.

It allows architects to visualize the finished project before construction begins, and it can also help them make decisions about materials and colors. Moreover, it can save time and money by avoiding costly mistakes. In addition, it can also increase the client’s confidence in the design process and reduce the need for physical prototypes.

A 3D modeling company offers a wide range of services, from simple images to complex animations and video walkthroughs. They can help you create a model that will meet your specific needs and budget. They will provide you with a detailed quote and timeframe for the project. You should choose a company that has experience working with your industry and can interpret technical drawings.

In the construction industry, 3D modeling can be an invaluable tool for reducing construction costs. It allows clients to view the entire project from different perspectives and can even be viewed in real-time, which makes it easier for all stakeholders to collaborate. Moreover, it can also help reduce the risk of errors and omissions in construction documents by minimizing the number of revisions.

Moreover, it can be used for marketing purposes, such as creating promotional videos and VR experiences. This way, your brand can stand out from the competition and attract more customers. 3D modeling can be a key ingredient for successful branding and growth.

With a wide array of 3D visualization services, it’s important to choose the right agency for your business. Look for a firm with experience in your industry, and one that offers reasonable prices. A reputable 3D design company can transform your vision into a realistic image that will help you win the trust of potential clients and investors.

3D visualization

3D visualization is a powerful tool for ensuring that a client’s idealized vision of a project comes to life. It reduces the need for costly physical prototypes and streamlines design and construction processes. Additionally, it helps to identify and communicate design errors earlier in the process. It also allows designers to experiment with different design options before they commit to a final design. In addition, 3D visualization can be used to create virtual experiences that allow clients to feel the space and experience its functionality.

The use of 3D modeling and rendering software has revolutionized the way architects, industrial designers, and interior designers work with their clients. The process allows them to quickly and easily create realistic images of a project before it’s completed, which saves time and money and improves communication. It also enables them to create high-quality graphics that can be exported to a variety of formats.

Many companies offer 3D design consulting services. Some specialize in particular areas, while others can handle a variety of projects. For example, Vegacadd offers engineering and architectural 3D design services for a wide range of industries. Its team of experts can create high-quality images in a short period of time. Another company that provides 3D design consulting services is By3Design, which offers a unique blend of technical expertise and personalized service.

A 3D rendering is a computer-generated image of an object that is used for marketing purposes or as a prototype. These images can be saved in standard formats such as JPG and PNG for images or MPEG and MP4 for videos. This allows them to be viewed on a computer or mobile device without the need for CAD software. Renderings can be created in a variety of styles, including photorealistic and artistic. They can be saved as images, video clips, or animations and are useful in promoting products, events, and buildings.

3D visualization has been widely adopted in the manufacturing industry. It can be used to provide AR-guided assistance during production, virtual assembly process validation, technician training, and digital factory simulation. It can also be used to promote new product releases and support sales initiatives by delivering immersive design reviews and connecting design and construction. Using 3D visualization can also help architects and interior designers develop and test ideas before they are implemented. This enables them to respond to stakeholder feedback and make iterative changes to the designs.

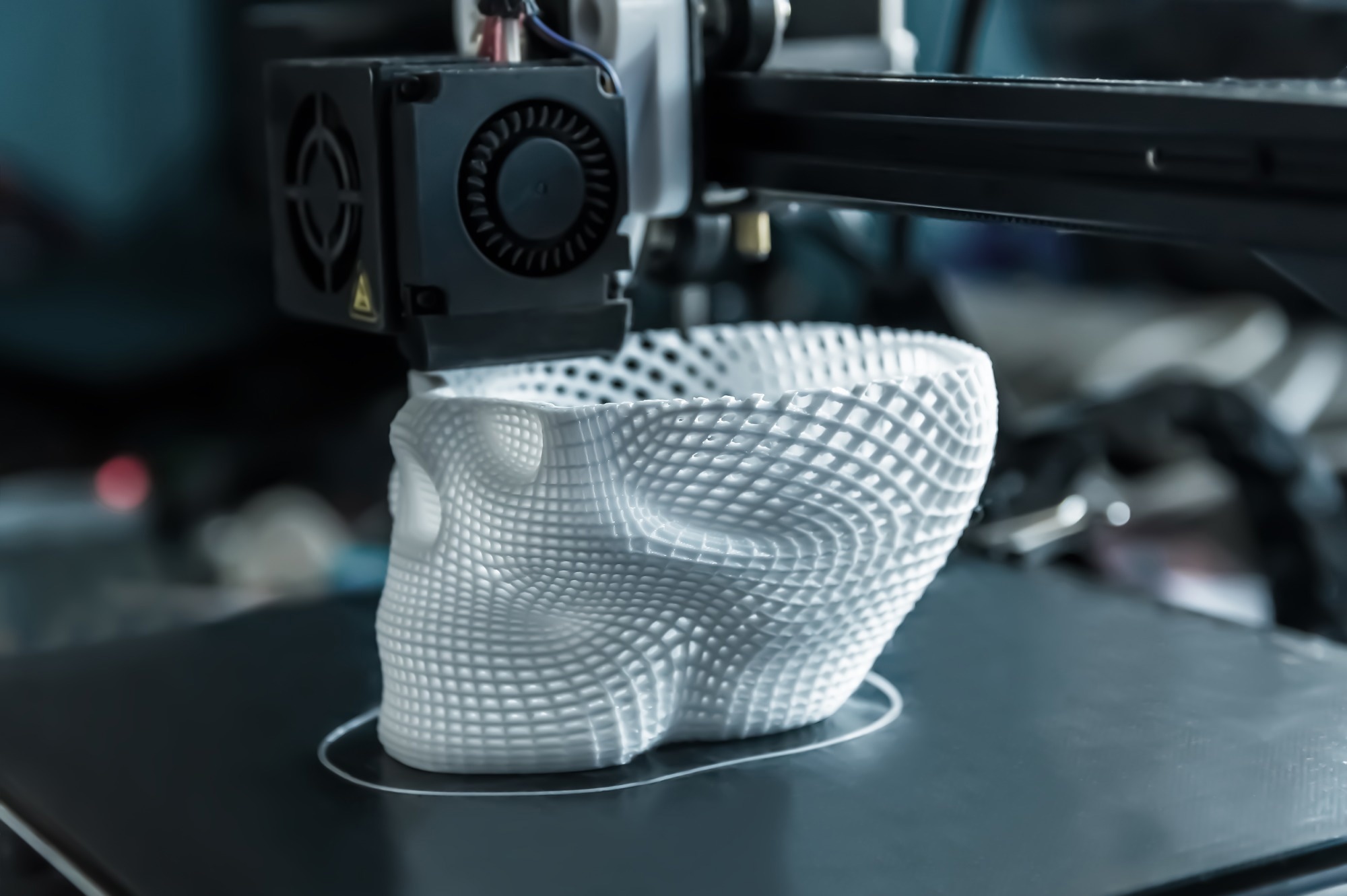

3D prototyping

3D prototyping is a useful tool for designers to create realistic images of projects. It can help save time and money, improve communication with clients, and reduce design errors. It is also an excellent way to streamline production planning and improve collaboration with team members. These services can be used in a variety of industries, including architecture, interior design, and furniture. Some 3D models even include sound and lighting to make them more lifelike. 3D modeling is also a great tool for marketing, as it can be used to make virtual renderings of products and scenes. This allows marketers to get a better idea of how the final product will look and feel. 3D visualization can also help to increase customer engagement and sales.

Using 3D software to prototype can save designers a significant amount of time and money by eliminating the need for physical prototypes. This allows them to make changes quickly and easily, and ensures that the finished product will reflect their original vision. It also helps to reduce design mistakes and rework. The 3D modeling process can be applied to any project, from home renovations to industrial construction projects. It can also be used to create virtual tours of retail spaces.

Some companies use 3D printing to produce functional prototypes, which are meant to demonstrate the functions of a product rather than its appearance. Creating these prototypes can help designers decide which features are essential and which ones may be impractical. They can also be used to test various components of the product, which will help to improve overall performance and quality.

Other businesses use 3D modelling to test the viability of an idea before it is fully fabricated. This can help to improve the quality of the finished product and ensure that it meets regulatory requirements. It can also be used to reduce costs by reducing the number of prototypes needed for testing.

When hiring a 3D modeling service, it is important to check their credentials and portfolio. The best ones have a strong understanding of their industry and a deep appreciation for the needs of their clients. They should also have a proven track record of successful projects. In addition, they should be able to provide a competitive price and a flexible timeline.

3D animation

3D animation is a popular tool for businesses to convey ideas and concepts in an effective manner. It can help reduce design errors and streamline the product development process. It can also be used to improve communication with clients, which can result in faster decisions and less rework. Moreover, it can also save money by eliminating the need for physical prototypes. In addition, it can enhance the company’s reputation and increase revenue.

A quality animated 3D video can make your business stand out from the competition and attract new customers. It can be used for a variety of purposes, from explaining complicated products to engaging customers with an immersive experience. It can even be used to promote a specific event or campaign. Animated videos can also be shared on social media, which helps reach a wider audience and drive more conversions.

The animation process is complex and involves several steps, including conceptualizing and storyboarding, modeling, texturing, rigging, and compositing. It can also include special effects and music. Depending on the project, it can be done using different techniques, including keyframing and procedural animation. Procedural animation uses algorithms to automate complex movements, resulting in a more realistic result. It is also a great choice for large-scale projects.

3D animation can also be combined with virtual reality to create a more interactive and immersive experience. This is particularly useful for medical procedures, where it can help reduce patient anxiety by allowing them to see the results of their procedure in real time. For example, patients can be shown lifelike images of beaches and forests to calm them during MRI scans. In addition, pharmaceutical companies can use 3D animation to show the mechanisms of drug treatment, enhancing professional and patient understanding.

A 3D design consultant can help you develop a high-quality visual prototype of your product, which can save time and money by eliminating the need for a physical model. They can also provide detailed estimates and quotes for your project. They should be able to understand the technical drawings and specifications provided by your company, as well as be flexible enough to change designs and materials as necessary.

What is the difference between investing in real estate and other investments?

Real estate is a very important asset for companies of all sizes. The industry is regulated and complex, requiring a wide range of skills to succeed in.

A real estate blog can be used to educate and attract potential clients. Popular topics include: housing trends, property valuations, and the rent vs buy choice. Click Top Real Estate Companies In Houston to know more.

Real estate is a broad term that refers to any property or land that is permanently attached to the earth. This includes houses, office buildings, apartment complexes, strip centers, warehouses and even vacant land. It also encompasses any structures, including decks, trees, sewers and pools that are within the boundaries of the property. The value of real estate can appreciate or depreciate, depending on the market conditions.

There are several different careers in real estate, ranging from brokerage to mortgage lending to appraisal. Many people also choose to become real estate investors, purchasing and holding properties for long-term gain. The real estate industry is governed by local, state and federal laws that govern land ownership and use. The value of real estate is a leading indicator of an economy’s health and generates millions of jobs in home improvement, development, investment and management.

The three types of real estate are residential, commercial and industrial. Residential real estate includes new construction and resale homes. This includes single-family homes as well as condos, townhouses and duplexes. Commercial real estate refers to any property used for business purposes, such as offices, stores and restaurants. It can also include strip malls, warehouses and hotels. Apartments, though often used as homes, are considered commercial real estate because they are owned to produce income.

New real estate includes both resale homes and new construction. The latter involves a project that requires the collaboration of developers, architects, engineers and contractors to create a building or other structure on the land. The development and construction phases of new real estate can take years. New buildings are often built on spec, or to order, so that buyers know exactly what they will get when they purchase the property.

The term “real property” differs from personal property, which includes all items that are not permanently attached to the land, such as cars, boats, jewelry and furniture. Real property has seven characteristics that are either financial or physical, including scarcity, improvements, location, investment permanence, uniqueness, immobility and Indestructibility. The financial characteristics of real estate relate to the investment potential and market value of the property, while the physical features are related to the property’s inherent qualities.

What is the difference between investing in real estate and other investments?

Investing in real estate is a popular way to grow your wealth. It offers a range of benefits, including the ability to generate income by renting out property. Additionally, real estate investments have a proven track record of generating returns. However, before investing in real estate, there are a few things to keep in mind.

There are many ways to invest in real estate, from buying and selling homes to investing in real estate investment trusts (REITs). The most common way to invest in real estate is by purchasing and leasing a residential property. This can include everything from single-family homes to apartment buildings. Real estate investors may also choose to invest in commercial properties, which are often leased out to businesses.

One of the biggest differences between real estate and other types of investments is that real estate is a physical asset. This means that you can touch and inspect the property to assess its value. This makes it a more familiar investment than stocks, mutual funds or ETFs. Additionally, real estate typically provides higher returns than other types of investments.

Another difference between real estate and other types of investments is the level of liquidity. It can be difficult to sell a piece of property quickly, and this can make it harder to rebalance your portfolio in a down market. In contrast, a portfolio of publicly traded stocks can be liquidated within minutes.

Directly investing in real estate is generally expensive and requires significant cash and due-diligence work. It can also be time consuming, as you will need to deal with issues such as maintenance and tenant turnover. In addition, the process of acquiring and selling a property can take months.

Retail investors can now access commercial real estate through options like REITs and fractional ownership. This allows them to diversify their portfolios and earn better returns on their investments. Additionally, commercial property investments tend to have longer lease durations than residential properties, which can help to mitigate vacancy risks.

How do I invest in real estate?

If you’re interested in real estate investing, you may wonder how exactly it works. Whether you’re thinking about buying an investment property, swapping your rent check for equity or house flipping, it’s important to understand what’s involved in each strategy before getting started. Real estate can be an attractive alternative or addition to stocks, bonds and mutual funds. But it isn’t a guaranteed way to make money, and there are plenty of risks that come with it.

Investing in real estate can be a lucrative strategy, but it’s not for everyone. It requires a lot of research, including understanding your local market and doing your homework to find properties that will increase in value and bring in steady rental income. You also need to be prepared for unforeseen costs, like appliance failures or vacancies, so it’s essential to have a strong emergency fund in place.

Another option for investing in real estate is to partner with other investors in a joint venture. This can be done through a syndication, partnership or investment fund, which can help reduce your risk and provide equity and distributions to limited partners. This type of investing is typically more passive, but it’s not without its own set of challenges.

If you prefer a less hands-on approach, you can also invest in real estate through mortgage-backed securities (MBS), which are made up of federally insured loans. These investments are often backed by government-sponsored enterprises, such as Fannie Mae and Freddie Mac, and can be found through many investment brokers or online platforms.

If you’re looking to invest in commercial real estate, you can do so by purchasing shares of REITs, which own and manage commercial properties. These companies are listed on the stock exchange, so you can purchase shares and diversify your exposure to real estate. This type of investing is typically more liquid, but it can still be risky if real estate prices decline or if you’re not able to sell your shares. If you’re unsure how to get started with investing in real estate, consider connecting with a Ramsey Trusted Advisor who can help you understand your local market and connect you with properties that fit your budget and risk appetite.

What are the benefits of investing in real estate?

One of the primary benefits of investing in real estate is the generation of cash flow. This is essentially the profit that rental properties generate after paying mortgage, insurance, property taxes and any repairs. This monthly income can help investors offset their expenses and put money back into their pockets, and over time it can grow enough to make up for the initial investment that was required to buy the property.

Another benefit of real estate investments is the ability to leverage capital. This means that investors can invest a smaller amount of their own funds to initiate a larger number of real estate deals than they would be able to with other types of investments. This also allows investors to diversify their portfolios and reduce their overall risk by spreading their assets across multiple asset classes.

Finally, real estate investments can provide a steady stream of income that can be used to pay off mortgages, cover living expenses, or even supplement retirement income. This passive income can be very attractive to many investors, particularly those who want to avoid the volatility of stocks and bonds and instead rely on stable, consistent cash flows from their investments.

Depending on the type of real estate, there are a variety of different ways to invest in it. These include purchasing single-family homes or condos to use as rental properties, commercial properties such as retail spaces or warehouses, and house flipping (buying undervalued properties, then renovating them and selling them for a profit).

Real estate investment can be an excellent way to generate passive income, but it can also be a great way to build wealth and create financial security. The key is to find the right type of property that fits your investment goals and financial situation.

Investing in real estate is not without its challenges, however. Like any other type of investment, it can be a high-risk endeavor that can take years to yield a financial return. Additionally, real estate is a physical asset that can’t be sold as easily or quickly as a stock or bond. This can make it a difficult investment for some investors to get into, especially in a seller’s market.

Gutter Cleaning Made Easy

If you feel secure enough on a ladder and don’t mind the mess, gutter cleaning can be an affordable DIY project. A well-maintained gutter system ensures that water and ice flow freely off your roof, minimizing basement flooding and fueling mildew growth.

Start vacuuming from a downspout and work along the length of the gutter section, taking care to clear all downspouts as you go. Contact Gutter Cleaning Sarasota now!

Gutter cleaning is one of the most dangerous household chores, so you need a top-quality ladder. The best choice for your home is an aluminium extension ladder with a stabiliser bar. These are lightweight and sturdy, with box section stiles that are super strong and stiff, making them reassuring to use. They also feature a wide, comfortable work platform and conform to BSEN131 standards. They are ideal for homeowners and traders alike.

You can find ladders for gutter cleaning in many different sizes, but the right one will depend on the height of your building and the distance to the gutter. A step ladder is suitable for single-storey buildings, while an extension ladder will be needed for two-storey homes. A telescoping ladder is another option, as it can be adjusted to various height levels with a simple click of the button. These ladders can be a bit pricey, but they are extremely portable and versatile, making them worth the investment.

Once you have your ladder, it is important to set it up on an even surface. Ladders placed on uneven ground can be unsafe for you and anyone below you. You should also make sure the ladder is not in a position where it will hit any plants or other objects on your property. Additionally, it is essential to set the ladder up at the correct angle-most modern ladders have a safety mark that indicates the safest angle to use.

You should never attempt to adjust or extend the ladder while you are on it, as this is extremely dangerous and can lead to falls. It is a good idea to keep a tool bag or bucket nearby, so that you can easily pick up and drop items while cleaning. It is also a good idea to wear gloves and eye protection while working on a ladder. Finally, don’t overreach while on the ladder-this is one of the most common causes of falls from ladders. The best way to prevent this is to take regular breaks and have someone on the ground to hold the ladder steady.

Scoop

A gutter scoop is a hand-held tool that helps you reach inside your gutters and remove debris. It has a flexible body that conforms to the shape of your gutter and makes it easier to maneuver. It’s also compatible with extension poles to help you reach further down. It’s the perfect tool for both residential and professional gutter maintenance services. Regular gutter cleaning and clearing prevents water damage, mildew growth, soil erosion, and landscaping damage. It also ensures that your gutter system works efficiently, with unobstructed flow.

A well-designed gutter scoop has a spoon shape that fits into your gutters to make it easy to grab and remove debris. It’s also crafted from a durable material like plastic or metal to handle the gritty, contaminated mess that is gutter debris. This sturdy design reduces strain on your arms, helping you work more quickly and efficiently.

Some gutter scoops have attachments that can be used with a garden hose. This can be helpful if you’re cleaning caked-on gunk, as it may require the higher pressure of a hose to dislodge it. However, this method is not recommended if your gutter downpipes are already blocked. You could end up washing more debris into the pipes, making the problem worse.

For more serious or frequent blockages, a gutter vacuum cleaner may be a better option. These powerful tools remove debris and leaves from the ground level, minimizing ladder time and increasing efficiency. They also have a high suction power to tackle the most stubborn debris. They’re typically not cheap, but they can save you time and money in the long run. For maximum safety and effectiveness, you should use them in conjunction with a ladder to prevent falls or other accidents.

Garden hose

Your garden hose, when equipped with a gutter-cleaning attachment, can make it easier to clean your home’s gutters from the ground rather than from a ladder. These attachments clip to the end of a standard garden hose and have a U-shaped design that lets you direct the water over your gutters. They also come with a spray nozzle that lets you control the direction and intensity of the water — look for one with adjustable settings, which can help you get better leverage for cleaning tough-to-reach areas or hard-to-reach sections of your gutters.

A gutter-cleaning attachment also works well for unclogging downspouts, which are the vertically oriented pieces of gutter at the ends of your roof that direct rainwater to the ground and away from your house. The easiest way to test for a downspout clog is to simply point the gutter-cleaning nozzle inside the downspout opening and turn on the water. If the nozzle doesn’t dislodge the clog, try inserting a plumber’s snake into the downspout and twisting it back and forth (interspersed with spurts of water from the hose) to break up the clog.

Another way to keep downspouts from becoming clogged is by installing a downspout strainer, which is a long piece of wire that fits into the opening of a downspout. These can be bought at most hardware stores and cost between $2 and $8 each, but they are well worth the investment since they eliminate clogs and help ensure that your downspouts function properly. Once you’ve cleared out the clogs and ensured that downspouts are functioning well, install a gutter guard to prevent clogs in the future. It’s a good idea to assess the slope of your gutters each time you clean them so that they are draining correctly; this process can change over time due to weather and other factors. You can do this by measuring the distance from the top of a downspout to the ground along a 10-foot section of the gutter — you can find this information in your home’s blueprints or by using a tape measure.

Handheld shovel or hook

Gutter cleaning tools that allow you to stay on the ground are ideal for DIYers who prefer not to climb ladders. There are several kits available that attach to wet/dry shop vacuums and leaf blowers, allowing the user to sweep debris into bags or push it loose with a wand attachment. Alternatively, there are specialized gutter cleaning nozzles that can be attached to standard garden hoses to increase water pressure and reach deeper into gutters. These nozzles usually feature an angled head to better dislodge leaves and other debris.

Another option is a handheld shovel or hook. These devices, which resemble large candy scoops, have a threaded design that grabs debris and pulls it to the ground. These are great for breaking up tough blockages and can save you the time and effort of repositioning your ladder every few feet as you clean each section of gutters. They aren’t as efficient as a telescoping claw, however, and require you to be comfortable on a ladder.

There are also a number of gutter cleaning kits that combine a telescoping claw with a shovel or scoop to maximize efficiency and minimize ladder use. These tools allow you to clear out your gutters in a fraction of the time it would take using just one tool. They are typically made of sturdy aluminum or plastic and have a gripping handle to ensure you can hold the tool comfortably as you work.

Regardless of which type of gutter cleaner you choose, be sure to wear protective gloves and eye protection when working outdoors. Gunk from clogged gutters can contain mold, animal droppings and other toxic materials that may cause harm if inhaled. It’s also a good idea to cover your yard with a drop cloth or tarp so that you don’t end up dragging dirty debris around the rest of your home.

Lastly, there are a few different robotic gutter cleaning tools on the market that can be operated by a remote control. These robots are designed to go into the gutter and blast away clogs and other debris while you watch from the safety of the ground.

Investing in Real Estate

Goldstream Land Group is everywhere, from suburban homes to skyscrapers in major cities. But the industry is complex, with rules and terminology that can be hard to understand.

Some important facts exist whether you’re an investor or just curious about real estate. Here’s a primer.

While the terms real estate and real property are often used interchangeably, there is a distinct difference between them. Real estate is land and everything permanently attached to it, including buildings, homes, fences, or natural resources like water or minerals. This also includes the rights to own, sell, lease, or use that land. On the other hand, real property is personal items not attached to land, such as cars, boats, jewelry, or furniture.

There are many different types of real estate, each with unique rules and regulations. For example, residential real estate is used for housing and cannot be used for businesses such as retail stores or offices. On the other hand, commercial or industrial real estate can be used for business purposes and may include warehouses, office buildings, strip malls, or restaurants.

Investing in real estate can be an excellent way to grow wealth and diversify your portfolio. However, it is important to understand the basics of real estate before investing. This will help you make wise decisions and avoid making costly mistakes.

The massive real estate industry includes numerous specialists with specialized job titles and responsibilities. For instance, real estate agents and brokers buy, sell, and manage properties on behalf of clients. Developers are those who purchase land and build new structures on it. Appraisers are individuals who evaluate the value of real estate. Other important real estate industry members include support staff, attorneys, and loan officers.

The real estate industry contributes greatly to the economy and is essential to any developed nation. New real estate construction is a major contributor to the gross domestic product (GDP). The construction of new homes and other real estate also accounts for a significant percentage of employment in the United States. For this reason, the real estate industry is a vital part of any economy, and it is important to understand the basic principles and practices that govern this type of investment.

Real estate includes land and the permanent structures that are tied to it. This is in contrast to personal property, which refers to goods without physical permanence and includes things like cars, boats, jewelry, clothing, and tools.

There are four types of real estate: land, residential, commercial and industrial. Each type has its unique investment strategies, risks, and key considerations.

The most basic form of real estate is land, a piece of undeveloped earth with no buildings. Vacant land can be purchased and sold for profit. It’s also often used as the basis for building new properties and is a common part of mixed-use developments that feature retail, office, and housing elements.

Residential real estate includes homes for people to live in and is the most familiar type of real estate. It encompasses everything from single-family houses to multifamily multifamily rental apartment buildings. This is the area most people are familiar with when it comes to real estate, and it’s also a sector that continues to grow as more and more people choose to live independently.

Commercial real estate is designed for business use and valued based on income-generating potential. This can range from office buildings and strip malls to retail stores and standalone restaurants, including hotel properties. This category also covers manufacturing, research and development, distribution, and warehousing places.

Industrial real estate is a subset of commercial real estate and includes property primarily used for manufacturing or storing goods. It’s sometimes confused with distribution centers, which are more similar to warehouses than offices or shopping malls. Industrial real estate can also include manufacturing plants, which are different from these other kinds of facilities designed specifically for production and manufacturing. It can also have storage areas and distribution centers for food and beverage companies. Industrial real estate is sometimes called “real industrial property.”

Ownership is the legal relationship between an entity (person, group, or corporation) and a thing. This includes a right to use, possess, and transfer ownership of that thing. It also gives the owner a bundle of rights that can exclude others and enjoy the property without interference. This bundle of rights also includes the rights to alienate and destroy the item and recover possession of the property if it is lost.

Real estate ownership includes the right to live in, rent, or sell a home. It also includes the right to build on, develop, and change the land. However, owners have to follow the law to keep their rights safe from other people. In addition, a person or group with the ownership of a piece of land is responsible for maintaining that piece of property.

Often, homes are listed as having only one name on the deed and title. This indicates sole ownership of the property. This type of ownership has all the rights and responsibilities associated with it. It is possible to have joint tenancy ownership of a home with other parties. Married couples or family members often use this type of ownership. The main benefit of this form of ownership is that if a joint owner passes away, the other party automatically receives the property’s share.

Another common type of property ownership is cooperative housing. This is often seen in City’s Upper East Side areas. This form of property ownership involves owning shares in a company that manages the building. The residents have the right to rent or sell their units under the rules set by the cooperative.

Investors who own residential or commercial real estate can use it to generate income in several ways, including renting out space, improving and selling the property, or flipping properties. The value of real estate can rise or fall depending on the market and local economic conditions. For example, if inflation rises, the value of real estate will likely increase as prices for goods and services rise. In contrast, if interest rates rise, homeowners’ mortgage payments may become more expensive.

Investors can use real estate to generate recurring passive income and property appreciation over the long term. Many traditional investments, such as single-family rental homes, offer this opportunity — and are easy to finance — but others, like small multifamily or commercial self-storage properties, can provide higher returns and diversification to investors’ portfolios. Historically, real estate investments have also provided downturn protection, as they tend to maintain or increase value during recessions.

Leverage is one of the biggest advantages real estate offers as an investment option, giving investors full ownership of a significant asset with only a relatively low initial investment. This allows investors to grow their wealth and accelerate the pace at which they can achieve their investment goals. However, it’s important to understand the potential pitfalls of leverage when investing in real estate and make wise choices to minimize risk.

Equity, or the value of the land and improvements on it, is another major benefit of investing in real estate. As you pay off your mortgage and your property appreciates, you build equity, a form of personal wealth that can be used for future investments or liquidated to cover financial obligations in an emergency.

Compared to stocks, which can be volatile and have a high correlation with inflation, well-chosen real estate investments generally offer more stability and appreciation over the long term. This makes them a valuable addition to any diversified portfolio.

Real estate can be an excellent way to generate a steady flow of passive income, but it takes a lot of work to become rich. It takes careful research to identify a market and a property that will provide good returns, and unexpected expenses like repairs or vacancies may arise. That’s why it’s important to budget for these surprises and set aside cash reserves in emergencies.

There are various ways to invest in real estate, including direct ownership and real estate investment trusts (REITs). REITs allow you to gain exposure to a broader selection of real estate assets by purchasing shares in a publicly traded company that owns and manages properties. Some brokerages also offer REIT mutual funds you can buy through your regular investing account. Other options include crowdfunding platforms and real estate development companies that connect developers with investors.